Want Your business to Thrive?

Stay connected with our weekly newsletter that contains tips and actionable advice you can use.

- Jul 31, 2023

The Power of the Profit First Instant Assessment Calculator

Today, let's talk about how to assess the health of your business. This process can be a wake-up call for many business owners. It's time to decide: do you want to continue struggling to pay your bills, or do you want your bank account to grow and give you more freedom in your business and life?

Profit First Instant Assessment Calculator

The key tool we'll be using is from the book, "Profit First" written by Mike Michalowicz. It's called the Profit First Instant Assessment Calculator. This tool is designed to help you understand the real financial health of your business. It's not about accounting or bookkeeping; it's about understanding your actual cash flow.

The Profit First Instant Assessment Calculator is based on the insights gained from thousands of financially successful and profitable companies. It provides a guide on how to best use your cash in your business.

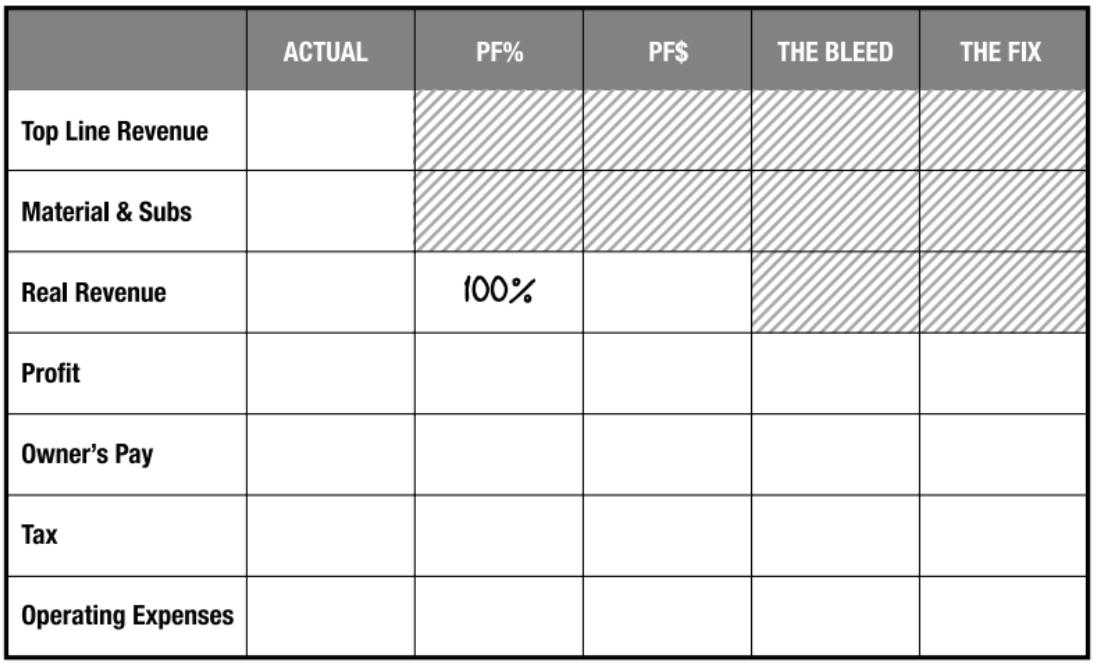

Here’s what the Instant Assessment form looks like on page 62:

I created my own version in Excel of the Profit Assessment which makes this step a breeze! Grab your copy HERE.

Your "Real" Revenue

To get started, you'll need your Profit and Loss (P&L) statement and balance sheet. We'll use these to calculate your "Real Revenue," which is the actual money your firm is making to operate on. This is different from your total revenue, which includes materials and subcontractor costs.

Understanding Profit First Percentages

In the Profit First system, your income is divided into four main categories: Profit, Owner's Compensation, Taxes, and Operating Expenses. These figures will help us understand where your money is going and how it's being used. Each of these categories is assigned a percentage of your income. These are the Profit First Percentages.

Profit

This is the money that is set aside as pure profit. It's the reward you get for being a business owner and taking the risk of running a business. The Profit First system recommends starting with a small percentage, even as low as 1%, and gradually increasing it over time.

Owner's Compensation

This is the salary that you, as the business owner, pay yourself for the work you do in the business. It's separate from the profit, which is your reward for owning the business. The recommended percentage for Owner's Compensation varies depending on the size of your business, but it's often one of the larger allocations.

Taxes

This money is set aside to pay your business's tax obligations. By setting aside a percentage of your income for taxes right from the start, you ensure that you're always prepared for tax time. The recommended percentage for Taxes also varies depending on the size and structure of your business.

Operating Expenses

This is the money used to pay for everything else that your business needs to operate. This includes things like rent, utilities, supplies, and employee salaries. The goal of the Profit First system is to minimize Operating Expenses as much as possible, so this percentage is often lower than you might expect.

The exact Profit First Percentages that you use will depend on your specific business and financial situation. However, the key idea is to prioritize Profit and Owner's Compensation, and to minimize Operating Expenses. This ensures that you're always taking care of yourself and your business's financial health.

Finally, we'll compare your current percentages (CAPs) with the target allocation percentages (TAPs) based on Mike Michalowicz's research. This comparison will help us understand how healthy your business is and where improvements can be made.

Remember, these percentages are not perfect. They're a starting point to help you define your financial goals. The Profit First percentages are designed to be flexible and adaptable to your unique business needs.

Your Journey to Financial Health

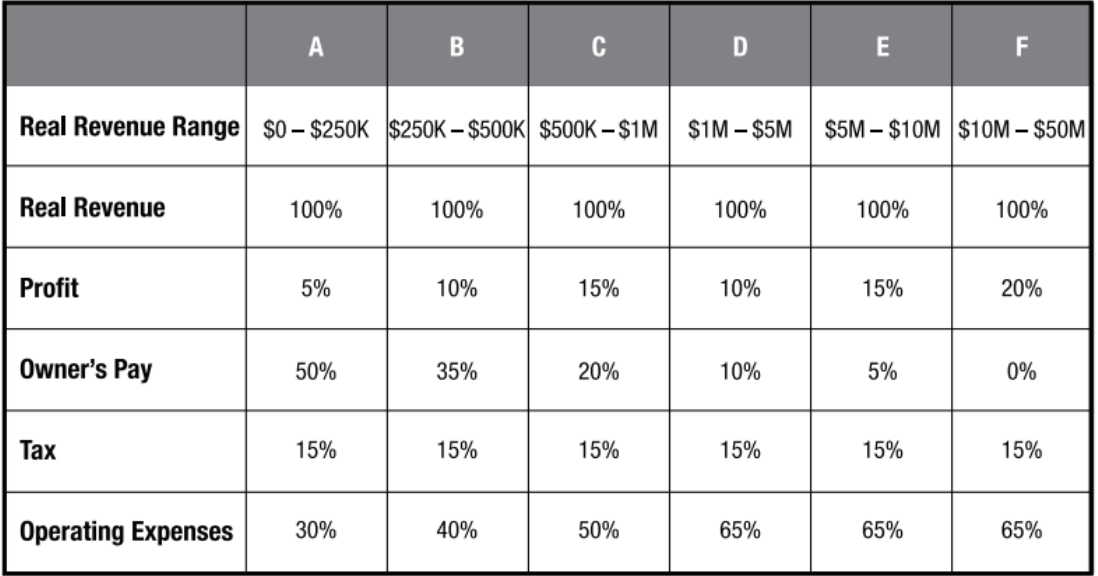

The journey to financial health varies depending on the size of your business.

A business doing less than $250,000 in revenue is typically a one-person operation. This company should have the most flexibility to reach their TAPs because they already have low overhead.

Businesses in the $250,000 to $500,000 range usually have employees and need basic systems, equipment, and substantial payroll costs. This means there will be a shift to increase operating expenses and decrease the owner's compensation.

As your firm grows from $500,000 to $1,000,000, you'll need more systems and people. You'll need to invest in these areas but also start building a reserve for your next growth spurt.

Once you hit the $1,000,000 to $5,000,000 range, systems become mandatory. Everything needs to be documented and shared - processes and checklists are a must.

Above $10,000,000, a company will typically stabilize and achieve predictable growth. The founder's income is almost only derived from profit allocations.

Based on the table from page 68 of the book, you will now compare your current percentages to the target percentages to determine how healthy your firm is. I personally struggled with how the Instant Assessment does this part with “delta” and “fix” columns. So my Excel version simplifies the output.

The Profit First Instant Assessment Calculator in Action

Mike shares an Instant Assessment he prepared for a law firm in his book. It shows real revenue of $1.2 million, with a low profit of $5,000 and taxes at $95,000. The majority of the money is being spent on owner's compensation ($190,000) and operating expenses ($943,000).

This Instant Assessment shows that too much is being spent on operating expenses and not enough is being saved for taxes. Remember, a healthy business will pay taxes! What needs to happen is tax planning. Finding a tax planner – not a tax preparer – someone who is an expert in planning and managing your tax bill is invaluable.

Whatever Your Current Assessment Is, Don't Panic!

Don't panic if your operating expenses are high. This is an exercise to determine the health of your firm. Now you know where you are and where you should head next.

The golden nugget here is: yes, you are being frugal as you buy each thing but are you really in need of the thing you are buying? Do you need an office if you always meet clients virtually?

Tell Me Your Thoughts!

I would love to hear your thoughts about this post. Please send me an email. I can be reached at kelley@ProfitScaleThrive.com.

Curious About Working with Profit Scale Thrive?

Running a successful law firm takes more than legal expertise—it requires financial mastery, strategic planning, and data-driven decision-making. At my accounting firm, Profit Scale Thrive, we specialize in helping law firms achieve lasting profitability by providing tailored financial guidance, optimizing cash flow, and equipping you with the insights needed to scale with confidence.

Ready to take your firm's finances to the next level? Join our private community for law firm owners called "Your Profitable Law Firm Community". Each month, we talk about essential topics specific to the business side of running a law firm. This is your opportunity to connect with other firm owners, share challenges, and discover proven solutions in a supportive environment.