Want Your business to Thrive?

Stay connected with our weekly newsletter that contains tips and actionable advice you can use.

- Feb 19, 2025

The New Annual Report Your Business May Need To File

Beneficial Ownership Information (BOI) & The Corporate Transparency Act (CTA)

2/19/25 Update - It appears that a FINAL notice has been reached. This new filing is required to be filed by all companies (unless they are on the short list of exempted entities) by March 21, 2025.

12/26/24 Update - I wish I were making this up, but the filing requirements are on hold again.

As of 12/23/24 - Lifted: Nationwide injunction halting the enforcement of BOI reporting — filing deadline is Jan. 13, 2025

A federal district court, finding that the Corporate Transparency Act (CTA) is likely unconstitutional, issued an order on December 3 prohibiting the enforcement of the CTA and the beneficial ownership information (BOI) reporting rule in the CTA’s accompanying regulations. Under this injunction, the Financial Crimes Enforcement Network (FinCEN) was barred from enforcing BOI filing requirements while the case was pending.

On December 5, the Department of Justice (DOJ) filed a formal notice of appeal to the Fifth Circuit court, seeking a stay of the injunction and challenging the injunction that prevented FinCEN from enforcing BOI reporting nationwide.

On December 13, the Attorney General filed an emergency motion to stay the injunction that prevented FinCEN from enforcing the BOI required reports.

On December 23, the Fifth Circuit Court granted FinCEN’s appeal to lift the injunction on BOI reporting. The AICPA is pushing FinCEN for a delay.

Until we hear otherwise, the BOI filing deadline is Jan. 13, 2025.

12/5/2024 Update - Nationwide injunction halts BOI reporting for now.

A federal district court, finding that the Corporate Transparency Act (CTA) is likely unconstitutional, issued an order Tuesday prohibiting the enforcement of the CTA and the beneficial ownership information (BOI) reporting rule in the CTA's accompanying regulations.

The injunction, which applies nationally, was issued in Texas Top Cop Shop, Inc. vs. Garland, No. 4:24-CV-478 (E.D. Texas 12/3/24).

Under the injunction, the CTA and the BOI reporting rule cannot be enforced, and reporting companies need not comply with the CTA's Jan. 1, 2025, BOI reporting deadline pending a further order of the court.

There is an important change that will affect many businesses starting on January 1, 2024. It's called the Corporate Transparency Act (CTA), which is part of the National Defense Authorization Act for Fiscal Year 2021. This law says that certain businesses must share information about who owns them.

This big update is meant to help the U.S. law enforcement stop crimes like money laundering and terrorism financing. It's different from tax rules because it falls under the Bank Secrecy Act. This means that instead of sending reports to the IRS, businesses will need to send them to the Financial Crimes Enforcement Network (FinCEN), which is part of the Department of Treasury.

You can access FinCEN's "BOI Small Entity Compliance Guide" here. The key highlights are as follows:

Who Needs to Report?

U.S. Entities: This includes corporations, LLCs, or similar groups registered with a state secretary or a similar office.

Foreign Entities: These are similar groups formed in another country but registered to do business in the U.S.

Exemptions

There are 23 categories that are exempt*, including publicly traded companies, banks, credit unions, and tax-exempt organizations. However, these exemptions are specific, and many of these groups already follow other reporting rules.

"Large operating entities" with over 20 U.S. employees, more than $5M in annual gross revenue, and a physical U.S. presence.

* See excerpt below of the 23 categories as shown by Chart 2 in the BOI Small Entity Compliance Guide (full document provided by FinCEN here).

What's a Beneficial Owner?

It's a person who has a lot of control** or at least a 25% ownership in a reporting company. The law explains "substantial control" in more detail.

** See excerpt below of the criteria for "substantial control" as shown by Chart 3 in the BOI Small Entity Compliance Guide (full document provided by FinCEN here).

When to Report?

New Entities (from 1/1/24): Report within 30 days (there might be a 90-day extension for entities created in 2024).

Existing Entities: Report by 1/1/25.

Updates or Corrections: Report within 30 days if there are changes or mistakes.

NOTE - this is NOT an annual report.

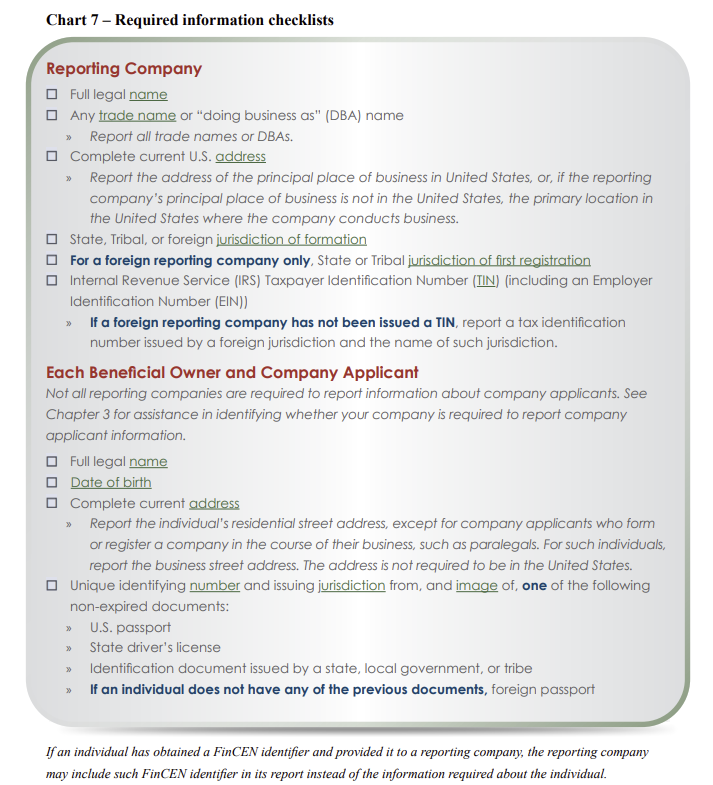

What Information is Needed?***

Company details like name, business address, where it was formed, and TIN.

Beneficial owner information, including personal details and ID documents.

*** See excerpt below of the information to be reported as shown by Chart 7 in the BOI Small Entity Compliance Guide (full document provided by FinCEN here).

What Happens if You Don't Follow the Rules?

There are big penalties! Not reporting properly can lead to fines up to $10,000, daily penalties of $500, and you might even go to jail for up to two years.

If you have questions or want to talk about how this affects your business, please contact us at 234.207.5772 or Kelley@ProfitScaleThrive.com. If you are a current accounting client of Profit Scale Thrive, we will discuss this during our next meeting.

In today's changing rules, it's important to stay on top of new requirements. We're here to work together with you. Our goal is not only to help you with your accounting and taxes but also to make sure you follow the law!

Not a client of Profit Scale Thrive? This is one example of the type of conversations we routinely have with our accounting and tax clients. Interested in learning more about how we work with our clients? Check out our services here or contact us to schedule a meeting here.

Curious About Working with Profit Scale Thrive?

Running a successful law firm takes more than legal expertise—it requires financial mastery, strategic planning, and data-driven decision-making. At my accounting firm, Profit Scale Thrive, we specialize in helping law firms achieve lasting profitability by providing tailored financial guidance, optimizing cash flow, and equipping you with the insights needed to scale with confidence.

Ready to take your firm's finances to the next level? Join our private community for law firm owners called "Your Profitable Law Firm Community." Each month, we dive deep into essential topics about the business side of running a law firm. This is your opportunity to connect with other firm owners, share challenges, and discover proven solutions in a supportive environment.