Want Your business to Thrive?

Stay connected with our weekly newsletter that contains tips and actionable advice you can use.

- Jan 24, 2024

Episode #41 – The Diagnostic Dashboard

Listen here

https://www.buzzsprout.com/2142680/14359749-episode-41-the-diagnostic-dashboard?client_source=small_player&iframe=true

Subscribe To The Podcast Here

Watch here

Read here

Welcome back to the podcast!

In our last episode I shared some tips on how you can adjust the format of your P&L to make it easier for you to read as a business owner. I hope you found that useful, but if you are still craving additional information to help you better manage your business that isn’t found in the typical financial statements, this episode is for you!

Why Do You Need More Info?

The standard financial statements were created by accountants for accountants when small businesses did not exist to the extent they do today. And while the accounting industry has evolved from using an abacus to pencil and paper to computers, the basic financial statements have only minimally changed over time.

Meanwhile, small businesses have grown from the handful of Mom & Pop stores on Main Street in every town to more than 33 million small businesses across the US. What do 33 million small business owners have in common? Most do not understand financial statements and most need information that isn’t even reported on their financial statements to manage their business.

For example, your financial statements won’t tell you how to make more money, if you can afford to hire another employee or why you have $150,000 in net profit this year but only $25,000 in your bank account.

What Else Do Small Business Owners Have In Common?

Here are the top 5 most common struggles I hear the most in my conversations with small business owners.

1. You Want Your Business To Be Successful But You Don't Know How

You're not alone in your aspirations for business success. Many business owners, like yourself, share the common desire to see their businesses flourish. It's a journey filled with dreams, hard work, and dedication. However, the path to success isn't always clear, and that's completely understandable. Running a successful business involves more than just numbers; it's about making strategic financial decisions, understanding your unique financial landscape, and ensuring that every financial move aligns with your business goals.

The challenge lies in not knowing exactly how to navigate this intricate journey. It's like having a destination in mind but lacking a roadmap to get there. The intricacies of financial management can be overwhelming.

2. The Catch-22 Of Business Ownership

Embarking on the journey of business ownership is a courageous step, and there are unique challenges that come with it. One of the most prevalent dilemmas business owners face is what I refer to as the 'Catch-22 of Business Ownership.' It's a situation where you want to grow your business, but you need cash to accomplish this. But you can't get more cash without growing your business.

You began your business because you're an expert in your field, and you envisioned a level of control over your time and the potential for increased earnings. However, the reality is that to achieve growth, you often need financial resources. It becomes a paradoxical scenario – you want to expand your business, but the required cash seems elusive. Without sufficient funds, you might find yourself caught in a cycle where growth becomes a challenge.

3. The Business Relies Too Much On You

When was the last time you took an unplugged vacation without worrying about the business falling apart? This sense of indispensability can lead to burnout and limit the scalability of your business. There is an intricate balance between managing day-to-day operations and creating a business that can operate efficiently even in your absence.

Breaking free from the hamster wheel of being indispensable is crucial for your well-being and the longevity of your business.

4. Every Day Is Filled With Overwhelm And Worry

It's not uncommon for the daily hustle of running a business to be accompanied by a sense of overwhelm and worry. As a business owner, your plate is likely full with numerous tasks, decisions, and uncertainties that can take a toll on your well-being. The weight of these responsibilities can create a constant feeling of being overwhelmed.

This overwhelm can extend beyond the professional realm, impacting your personal life and relationships. Sadly, this scenario is a shared experience among many business owners.

5. Do You Know What Works (And What Doesn't) In Your Business?

As a business owner, it's essential to have a clear understanding of what drives success and what might be hindering progress in your business. The question arises: Do you know what works (and what doesn't) in your business? It's a critical question that many business owners grapple with.

Business decisions should be rooted in a deep understanding of the factors contributing to success or potential challenges. Standard financial statements, while valuable, might not tell the whole story for business owners.

There Is An Easy Solution

The solution to each of these issues lies in creating consistent positive cash flow for your business. Ok, you may be thinking, you started off talking about my P&L, then 5 common struggles of business owners and now you are telling me to work on my cash flow. Hmm. What gives?

Ok – here’s the deal. I will admit it. Your P&L does not tell you a lot about your business. My goal with the last podcast episode was to help you tweak the format of your P&L to make it more useful than the standard “out of the box” report provided by every bookkeeping system. Because nearly all business owners have access to their P&L since it is a standard report provided by all bookkeeping applications.

My goal now is to introduce to you one new report that you can add to your monthly reporting package. This one is a game-changer – I promise!

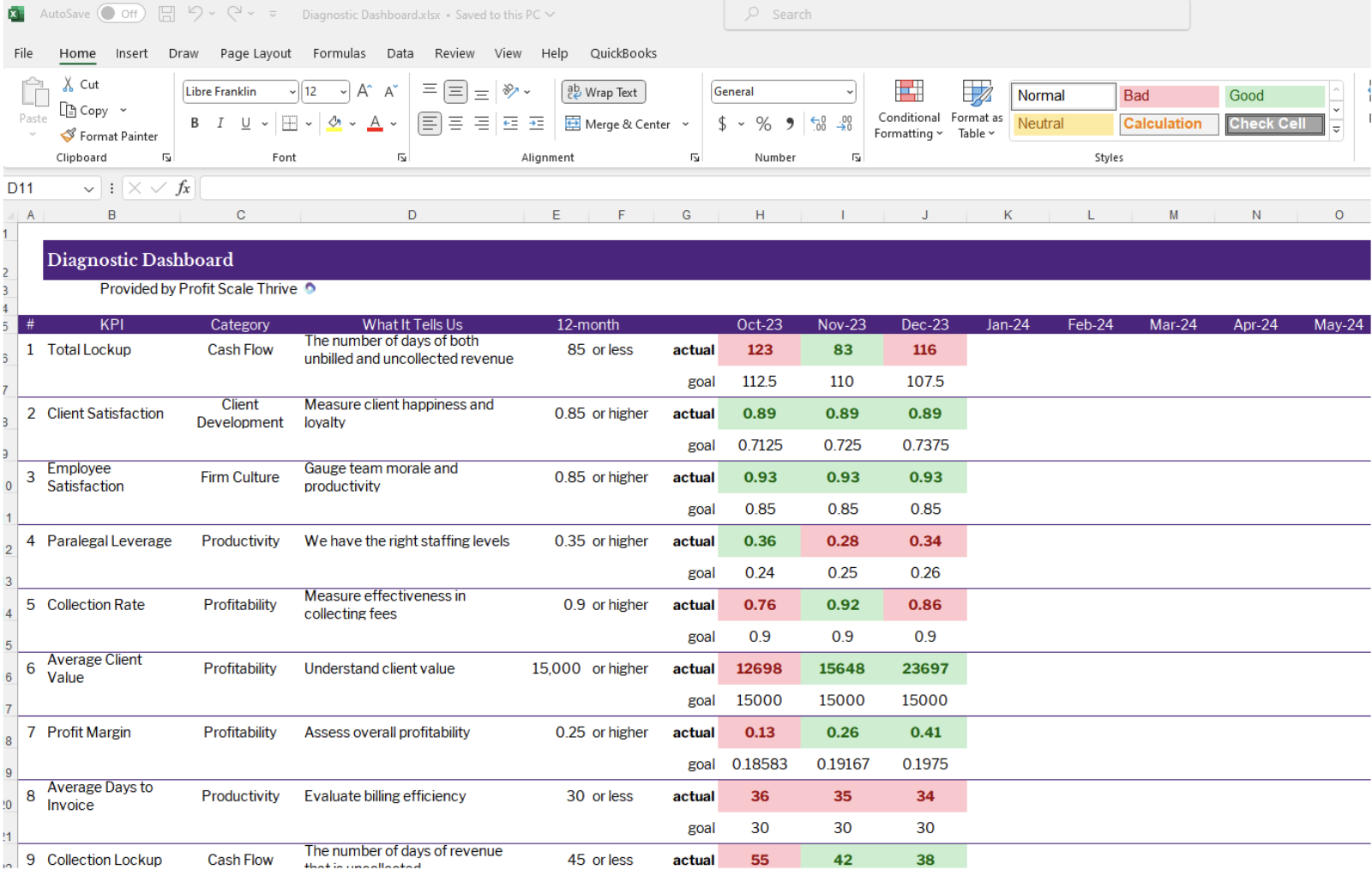

For my CFO clients, I call this the “Diagnostic Dashboard”. But this is something that you can create for your business. It is a report of your critical metrics, or KPIs. By tracking your KPIs, you'll gain a quick understanding of what works well and areas that might need adjustment.

No more making decisions based on your gut. Having this level of clarity empowers you to make strategic decisions based on data-driven insights. It's about transforming uncertainty into actionable knowledge, ensuring that every move you make aligns with the success of your business.

This Is Great, But How?

Let’s walk through how to create your KPI report. This is the process I use with my CFO clients when creating their Diagnostic Dashboard.

1. Define Your Vision

Document your vision for your business. For example, why did you start it? What are your business goals? What keeps you motivated?

There are no wrong answer here. Be honest with yourself. Your vision will need to be updated annually.

2. Goal Setting

Based on your vision, determine your 5-year goals for your business. Now, from this list, narrow down the full list to the top 3-5 goals you want to focus on for the next 12-months.

I want to emphasize that I said “12-month goals” and not “current year goals”. Chances are you are not listening to this podcast on January 1st. Do not let today’s date be an excuse for you to put off doing this. Work on this now and set your goals for the next 12 months.

For each goal, identify 1 or 2 KPIs that will tell you if you are meeting your goal or not. For each KPI, determine what you want this KPI to be in 12 months. Calculate each KPI for last month. Now, what is the difference between your 12-month KPI target and now for each KPI? Break down that difference into monthly milestones to guide you throughout the year.

Goals will need to be updated every 12 months.

3. Monthly Review

From the last step, you will have identified anywhere from 3-10 KPIs. Personally, I’m an advanced user of Excel. But, you can do this step with pen and paper. Do not let the format of your KPI report be a stumbling block. Ask your bookkeeper or a staff person to prepare this if you are struggling with creating your KPI report.

Once you have a report drafted, update and review your dashboard every month after your books have been closed by your bookkeeper. Celebrate achievements and determine the steps you need to complete in order to reach your next milestone.

Here is an example of the Diagnostic Dashboard I use with my CFO clients:

I would love to know your thoughts about ditching your financials in favor of a KPI report.

If you would like help creating a Diagnostic Dashboard for your firm or to learn more about CFO Services, please click HERE to schedule a curiosity call.

If you have any questions about today's episode please let me know. If you're watching on YouTube, you can comment below or send me an email to podcast@ProfitScaleThrive.com and if you know someone who might need to hear this information please share this episode with them or if you're on YouTube, you can tag them below.

Be sure to follow and subscribe to get notifications for future episodes.

Did you enjoy this episode? Please consider leaving a review.

And before I go, remember profit is something you intentionally plan for in the beginning. It is not a potential bonus at the end of the year.

Thanks, and have a great day.

In our last episode I shared some tips on how you can adjust the format of your P&L to make it easier for you to read as a business owner. I hope you found that useful, but if you are still craving additional information to help you better manage your business that isn’t found in the typical financial statements, this episode is for you!

If you would like help creating a Diagnostic Dashboard for your firm or to learn more about CFO Services, please click HERE to schedule a curiosity call.

✉️ EMAIL: podcast@ProfitScaleThrive.com

📞CALL: (234) 207-5772

💻 VISIT: ProfitScaleThrive.com

#entrepreneur #soloattorney #attorney #lawyer #sololawfirmowner #profitscalethrive #moneymindset #business #moneypodcast #sololawyers #smalllawfirms #cashstuffing #envelopemethod #profitfirst #goals #profitfirstforlawyers #CPA #CFO

Curious About Working with Profit Scale Thrive?

Running a successful law firm takes more than legal expertise—it requires financial mastery, strategic planning, and data-driven decision-making. At my accounting firm, Profit Scale Thrive, we specialize in helping law firms achieve lasting profitability by providing tailored financial guidance, optimizing cash flow, and equipping you with the insights needed to scale with confidence.

Ready to take your firm's finances to the next level? Join our private community for law firm owners called "Your Profitable Law Firm Community." Each month, we dive deep into essential topics about the business side of running a law firm. This is your opportunity to connect with other firm owners, share challenges, and discover proven solutions in a supportive environment.