Want Your business to Thrive?

Stay connected with our weekly newsletter that contains tips and actionable advice you can use.

- Jan 17, 2024

Episode #40 – A Better Profit and Loss Statement

Listen here

https://www.buzzsprout.com/2142680/14316767-episode-40-a-better-profit-and-loss-statement?client_source=small_player&iframe=true

Subscribe To The Podcast Here

Watch here

Read here

Today, let's talk about something important for your business – the Profit and Loss (P&L) statement. I'm a numbers person, and I want to help you understand your financials without all the confusing stuff. Imagine if your P&L was like a friend, easy to understand and always there to help you.

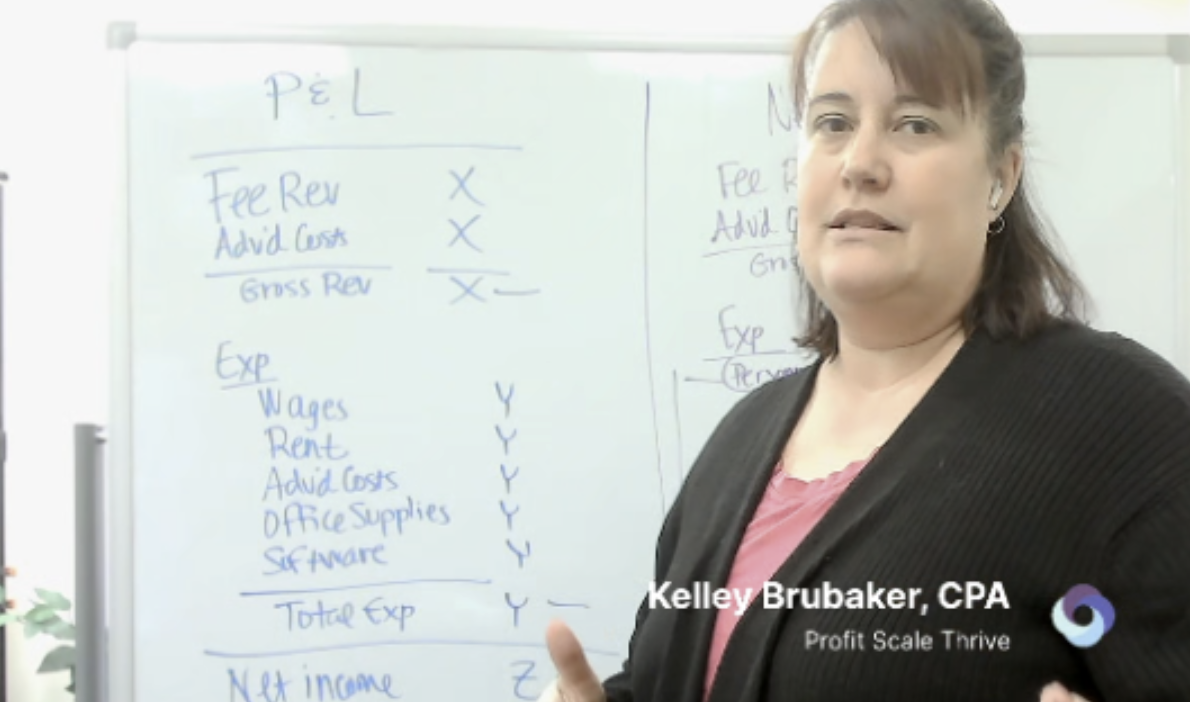

The Regular P&L:

Normally, financial statements are made for experts, not you. So, when you get a standard P&L, it's like getting a bunch of numbers that don't make much sense. It has income, costs, and a big list of expenses that might leave you scratching your head. Here’s an example:

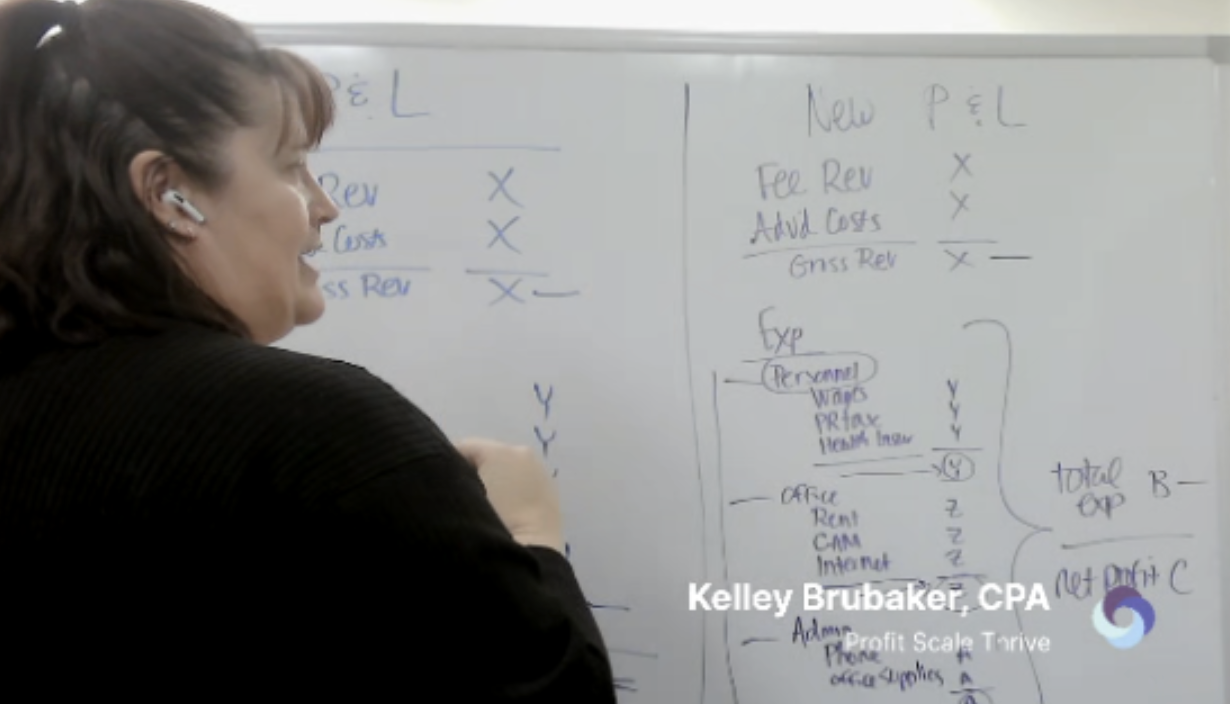

A New Look at P&L:

But what if your P&L could be more like a storybook, telling you about your business in a way that makes sense to you? Picture a P&L that groups expenses into categories that match how your business works. Here’s an example:

Making Sense of Sections:

In this new way, expenses are like puzzle pieces, put together in sections like people costs, office costs, and other costs. Each section shows a total, so you don't need to do tricky math. This change makes it much easier to see how your business is doing without feeling lost in all those numbers.

Parent and Children Accounts:

To make this change, think of parent and child accounts in your accounting software. Create new sections and put related expenses under them. It's like magic – your P&L now looks organized and easy to understand. And the best part? You only need to do this once in your accounting tool.

Compare and Choose:

Take a look at the old and new P&L formats. Which one seems easier for you? The goal is to make your financial report your friend, not a confusing puzzle. You want it to show your business in a way that clicks with you.

Simplify Your Decisions:

By spending a bit of time changing your P&L format, you're creating a report that's like a friend, not a puzzle. Whether you use QuickBooks, Xero, or another tool, having a P&L that makes sense is super cool.

Wrap-Up:

Your P&L is like a secret code for your business. It should be easy to understand, not a big headache. Remember, understanding your business money is important for making smart decisions. Share your thoughts, ask questions, and let's make your business finances easier together!

If you have any questions about today's episode please let me know. If you're watching on YouTube, you can comment below or send me an email to podcast@ProfitScaleThrive.com and if you know someone who might need to hear this information please share this episode with them or if you're on YouTube, you can tag them below.

Be sure to follow and subscribe to get notifications for future episodes.

Did you enjoy this episode? Please consider leaving a review.

And before I go, remember profit is something you intentionally plan for in the beginning. It is not a potential bonus at the end of the year.

Thanks, and have a great day.

Today, let's talk about something important for your business – the Profit and Loss (P&L) statement. I'm a numbers person, and I want to help you understand your financials without all the confusing stuff. Imagine if your P&L was like a friend, easy to understand and always there to help you.

✉️ EMAIL: podcast@ProfitScaleThrive.com

📞CALL: (234) 207-5772

💻 VISIT: ProfitScaleThrive.com

#entrepreneur #soloattorney #attorney #lawyer #sololawfirmowner #profitscalethrive #moneymindset #business #moneypodcast #sololawyers #smalllawfirms #cashstuffing #envelopemethod #profitfirst #goals #profitfirstforlawyers #CPA #CFO

Curious About Working with Profit Scale Thrive?

Running a successful law firm takes more than legal expertise—it requires financial mastery, strategic planning, and data-driven decision-making. At my accounting firm, Profit Scale Thrive, we specialize in helping law firms achieve lasting profitability by providing tailored financial guidance, optimizing cash flow, and equipping you with the insights needed to scale with confidence.

Ready to take your firm's finances to the next level? Join our private community for law firm owners called "Your Profitable Law Firm Community." Each month, we dive deep into essential topics about the business side of running a law firm. This is your opportunity to connect with other firm owners, share challenges, and discover proven solutions in a supportive environment.