Want Your business to Thrive?

Stay connected with our weekly newsletter that contains tips and actionable advice you can use.

- Apr 26, 2023

Ep #8 Profit First Chapter 4 – Assessing The Health Of Your Business

Listen here

https://www.buzzsprout.com/2142680/12714017-ep-8-profit-first-chapter-4-assessing-the-health-of-your-business?client_source=small_player&iframe=true

Subscribe To The Podcast Here

Watch here

Hello and thank you for joining us today on the Profit Scale Thrive Podcast, where we guide attorneys to overflowing profits, scaled growth, and thriving lives. I am your host, Kelley Brubaker.

We have a secret though - this is a special place because we don't work with every law firm owner, we support the solo attorneys who are single parents because we know the special challenges you face, and we know the business advice out there is not always practical for you and your firm.

Each week we will talk about things that will give you the insight you need to stop feeling overwhelmed, to gain back your confidence, and to finally enjoy your law firm and your life again.

Podcast Episode #8: Profit First Chapter 4 – Assessing The Health of Your Business

Hello and thanks for joining me today for podcast episode number eight.

Welcome back, or for those who don't know me yet, my name is Kelley Brubaker. I'm a business coach who supports solo attorneys who are single parents.

I'm also a certified Profit First Professional, which means I help my clients implement the cash management system presented in the book Profit First written by Mike Michalowicz.

A few weeks ago starting with episode 5 of my podcast, I began a dedicated series of podcasts to share with you in detail chapter by chapter of the book Profit First. So if you have read the book, please follow along as I will share tips not in the book along the way. If you have not read the book, but you are curious about it, please stick around as we go through chapter by chapter.

This week we are talking about Chapter 4 – Assessing the Health of Your Business. Mike starts this chapter by describing how one of the first reviewers of his draft of Profit First was upset with this chapter. And for good reason. It’s a “come to Jesus moment” for many business owners!

I don’t mean to scare you but please take this as a warning: this is an uncomfortable chapter. And, my simple advice here is you need to decide whether you wish to struggle to find money to pay your bills or if you want your bank account to grow and flourish to a point that you have a lot more freedom with your company and your life.

The (Almost) Instant Assessment

The book refers to this as the “Instant Assessment” and I sometimes refer to it as a “Profit Assessment”. Just so you know, these are the same things. Now, remember, Profit First is a cash management system, not an accounting or bookkeeping system. Accruals, depreciation, and accounts receivable do not matter because those are not cash – they are accounting things. We are talking about real money only. Profit First is to identify when cash has been received, where you can best put it to work for your firm.

The Instant Assessment is a form that Mike developed from interviewing thousands of fiscally elite and very profitable companies to guide you on how to best use your cash in your business.

To get started, you will need your P&L and balance sheet. If it’s easily available, I try to use the period for the 12 months ended last month. It’s currently April 2023 – so I would use the April 1, 2022 to March 31, 2023 P&L. If it’s not easily available, then the most recent 12-month P&L and balance sheet available is your starting point. Hopefully you have your bookkeeping up to date! The newest information will yield the best results. But, we need a starting point. And, keep in mind that this is something that you can and will do periodically going forward.

If your information is really outdated because your books are not updated, do not skip this step! Use ballpark numbers until you can get accurate information.

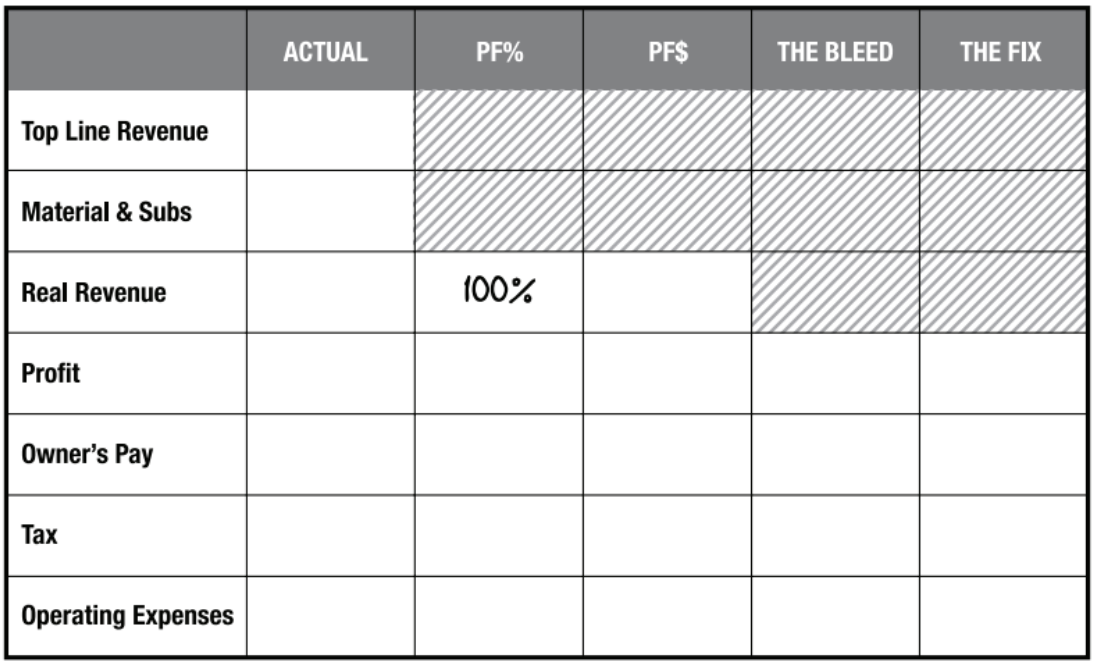

Here’s what the Instant Assessment form looks like on page 62:

I created my own version in Excel of the Profit Assessment that I will link in the notes to this podcast that makes this step a breeze!

So, let’s walk through this!

We start with Top Line Revenue. This is your total revenue from all sales in the 12-month period on your P&L. Total revenue may also be referred to as total income, total sales, revenue, sales or net sales.

The next line is called “materials & subs”. Many service-based businesses never use this line. For law firms, the only time I use it is when you have of counsel relationships who work on more than 25% of your case load. This line is meant to track your raw materials and significant cost of outsourced labor – but only labor that is only in place to generate revenue and they are NOT W2 employees paid through your firm’s payroll. If you have an outsourced receptionist, he or she does not generate revenue and would not be tracked on this line.

Do not overthink this line. If you are questioning what to put here, enter $0 and move to the next line.

So, our first calculation is to take your first number, total revenue, and subtract your materials & sub, which again for law firms will most likely be $0. The resulting number is your "Real Revenue”. This is the real, tangible money your firm is making to operate on. This will not be an eye-opening number for law firms, but for a business such as a retail store, this may be a shock because inventory would be included in the materials & subs line. For example, $2 million in total revenue but $1.5 million in materials & subs would leave only a half a million dollars left to operate the company…not the $2 million that the P&L would lead you to believe.

Please note that while materials & subs seems comparable to “cost of goods sold” and real revenue seems comparable to “gross profit” or “gross margin”, they are NOT the same. There are subtle differences, but remember our overriding principle is to track your actual cash in and out in a simple way.

Next, set aside your real revenue number for a moment and let’s look up your remaining numbers:

For profit – how much you actually have sitting in the bank or have distributed to owners over the 12 months as a bonus or on top of your salary.

For owner’s comp – how much did you actually pay all equity partners of the firm for payroll.

For tax – how much money has the firm paid of your tax bill. This is all taxes the firm paid for the firm itself and all equity partners personally. If you personal taxes are paid through your W2 paycheck or you wrote a check from your personal checkbook, then this amount is $0.

And lastly for opex – this is the total of your expenses. Don’t over think this – I see too many people get off track trying to account for every penny. My tip here is to take your real revenue number from above, subtract your profit, owner’s comp and tax balances and enter the resulting number as your opex.

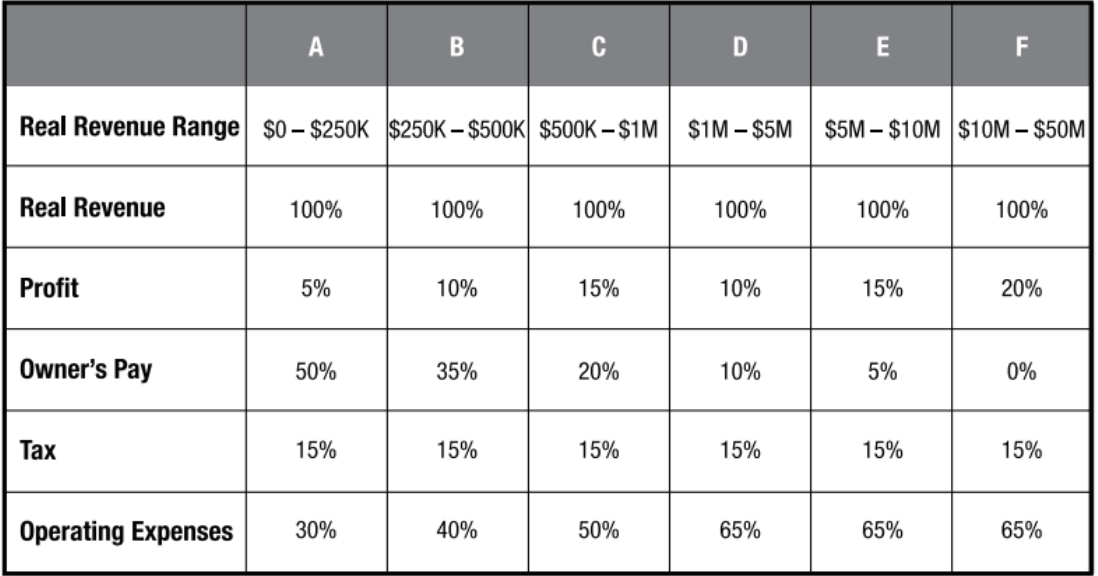

Now let’s get to the good part! Mike interviewed thousands of financially healthy and profitable companies and found trends that we are now going to apply to your firm. These percentages are called “TAP”s – target allocation percentages. Because all firms are different, we need to convert our dollars into percentages which will be referred to as “CAP”s – current allocation percentages. Again, if you download my Excel file for the Instant Assessment, this step will be done automatically for you.

Based on the table from page 68 of the book, you will now compare your current percentages to the target percentages to determine how healthy your firm is. I personally struggled with how the Instant Assessment does this part with “delta” and “fix” columns. So my Excel version simplifies the output.

What Do These Percentages and Numbers Mean?

Ok – so we have from Mike’s research what he determined healthy target percentages to be, but they are not perfect – they are meant to be an excellent starting point – a means by which to define your financial goals easier.

If you look at the chart above for TAPs, you will see companies are broken down into different revenue ranges – real revenue, not total revenue:

A business doing less than $250,000 in revenue is typically a one-person operation. This company should have the most flexibility to reach their TAPs because they already have low overhead.

Businesses in the $250,000 to $500,000 range likely have employees and will need basic systems, equipment and substantial payroll costs. So there will be a shift to increase opex and decrease owner’s comp – with good reason, the owner should be doing less work than they did as a solo practice.

Firms in the $500,000 to $1,000,000 range are on a growth trend needing more systems and more people. This firm will need to invest in people and systems but start building a reserve for their next growth spurt once they hit 7-figures.

From $1,000,000 to $5,000,000, systems are mandatory and should be in place. No more keeping things in people’s heads – they need to be documented and shared – processes and checklists are a must.

From $5,000,000 to $10,000,000, there’s typically a management team in place with a secondary management layer.

Above $10,000,000, a company will typically stabilize and achieve predictable growth. The founder’s income is almost only derived from profit allocations.

Mike shares on page 70 of the book an Instant Assessment he prepared for a law firm he was working with when he wrote the book. From my experience, this is not an unusual first Instant Assessment for a law firm. It shows real revenue of $1.2 million, with substantially low profit at $5,000 and taxes at $95,000. The majority of the money is being spent on owner’s comp ($190,000) and operating expenses ($943,000). While you may be upset that the owner’s comp was deemed to be too high at $190,000, consider the total picture here: with the profit and owner’s comp, Profit First would suggest total compensation to be $246,000 annually, not the current $195,000.

This Instant Assessment is showing that too much is being spent on operating expenses and not enough is being saved for taxes. And here’s the come to Jesus moment: a health business will pay taxes! There is no scenario where building a healthy business and putting more cash in your bank account will result in less taxes being paid.

What needs to happen is tax planning. Finding a tax planner – not a tax preparer – someone who is an expert in planning and managing your tax bill is invaluable now and going forward.

Don’t Panic!

I don’t remember any profit assessment I’ve prepared where a business is underspending on Opex. So, don’t panic. This is an exercise to determine the health of your firm. Now you know where you are and where you should head next.

How to get there? Don’t panic. Mike’s first book, The Toilet Paper Entrepreneur, is a great resource full of tips for saving money while growing your firm.

I’ve had so many conversations with clients over the years – they know they are being frugal but still struggling to manage their cash – here’s the golden nugget: yes, you are being frugal as you buy each thing but are you really in need of the thing you are buying? Do you need an office if you always meet clients virtually?

This is the toughest chapter – the realization of how your firm may have been bleeding money profusely for so long and how much money you could have in your bank account right now. Let that sink in. But, know we can fix it because knowledge is power!

Listener’s Question of the Week

And now, it’s time for our Listener’s Question of the Week!

Same as the last few weeks, instead of a listener’s question today, there is a side note in chapter 4 of Profit First that is something I would like to address here because I feel many people have the same question: What if my firm is brand new?

Here’s the answer directly from Mike (page 73 of the book):

How does Profit First work if you just launched your business and have no revenue? Should you wait until you have some to start Profit First? Heck, no. Starting with squat, with your whole business future ahead of you, is actually the best time to start using Profit First. Why? Because it allows you to form a powerful habit right from the get-go, when your business is forming and, perhaps more important, prevents you from developing bad financial habits that can be difficult to break.

Also, in the early stages of building a business, you need to spend as much time as possible on the selling and the doing; systems and processes come later. For these reasons, it's best not to worry about getting the exact right percentages for your business.

Simply use the percentages in the Instant Assessment for your target allocations, but start at 1% allocation for the profit account - why 1%? you'll find out in the next chapter - 50% for owner’s comp and 15% for the tax account. Use quarterly adjustments to step up to higher percentages and nudge your business closer to the TAPs recommended in this book. And as for the advanced Profit First strategies I share in the end of the book - don't worry about any of that until your business has been active for at least a year. The goal for new businesses is to form the basic core of Profit First good habit and then spend every other waking second getting your baby off the ground.

If you would like to submit a question for a future episode, please send an email to podcast@profitscalethrive.com – and no - by sending an email you will not get added to an email distribution list, there will not be a phone call and there will not be a sales pitch. We follow the golden rule – treat others how you wish to be treated!

Inspirational Quote

This week’s inspirational quote is from Jim Fortin – “When you manage your day by time you’ll never have enough time, you must manage by commitment.”

Final Thoughts

Final thoughts for today! I hope you are enjoying this approach to the book Profit First! Today we talked about how to easily and quickly assess the health of your firm. You can download my Excel file HERE to make it even easier!

Here is your action step for this week: do your Instant Assessment! It’s a big action step but it will help you reap rewards as you continue through the book. Just do it.

Next week, we are going to talk about the allocation percentages.

Please don’t be discouraged or overwhelmed at this point! What you are feeling is normal – totally and completely 100% normal.

If you need to pause here before moving to the next chapter, ok - but please set up your profit account and allocate 1% of your income each week. I know how this seems so small and pointless, but I promise there will be a noticeable impact on you and your business while you gain the benefit of creating a positive habit by the time you return to the book.

If you have any questions about today’s episode, feel free to comment if you are watching on YouTube or send me an email to podcast@profitscalethrive.com.

If you know someone who might need to hear this information, please share this episode with them or if you are on YouTube, tag them below!

Be sure to follow and subscribe to get notifications for future episodes.

Did you enjoy this episode? Please consider leaving a review.

And before I go – remember - profit is something you intentionally plan for in the beginning. It is not a potential bonus at the end of the year!

Thanks, and have an amazing day!

If you have not read the book “Profit First” written by Mike Michalowicz, today is your lucky day! This episode is the 4th installment of a series that dives into the book chapter by chapter.

This is the link to the Excel file for the Instant Assessment referred to in this podcast: CLICK HERE

Be sure to follow and subscribe to get notifications for future episodes!

✉️ EMAIL: podcast@ProfitScaleThrive.com

📞CALL: (234) 207-5772

💻 VISIT: www.ProfitScaleThrive.com

#entrepreneur #soloattorney #singleparent #attorney #lawyer #sololawfirmowner #profitscalethrive #moneymindset #business #moneypodcast #sololawyers #smalllawfirms #cashstuffing #envelopemethod #profitfirst #relay

Curious About Working with Profit Scale Thrive?

Running a successful law firm takes more than legal expertise—it requires financial mastery, strategic planning, and data-driven decision-making. At my accounting firm, Profit Scale Thrive, we specialize in helping law firms achieve lasting profitability by providing tailored financial guidance, optimizing cash flow, and equipping you with the insights needed to scale with confidence.

Ready to take your firm's finances to the next level? Join our private community for law firm owners called "Your Profitable Law Firm Community." Each month, we dive deep into essential topics about the business side of running a law firm. This is your opportunity to connect with other firm owners, share challenges, and discover proven solutions in a supportive environment.